Filing Your Taxes Made Simple: A Test blog to check live update

Filing taxes doesn’t have to be confusing or stressful. With the right approach and a clear understanding of the process, individuals and businesses can file accurate tax returns while avoiding common mistakes that lead to delays or penalties.

This step-by-step guide breaks down the tax filing process, explains what documents you need, and shares practical tips to help you file with confidence.

Who Needs to File a Tax Return?

Most individuals and businesses are required to file a tax return, depending on income level and local regulations.

Common Tax Filers Include

- Salaried employees

- Freelancers and self-employed professionals

- Small business owners

- Individuals with multiple income sources

Tip: Even if you’re not required to file, doing so may help you claim refunds or tax credits.

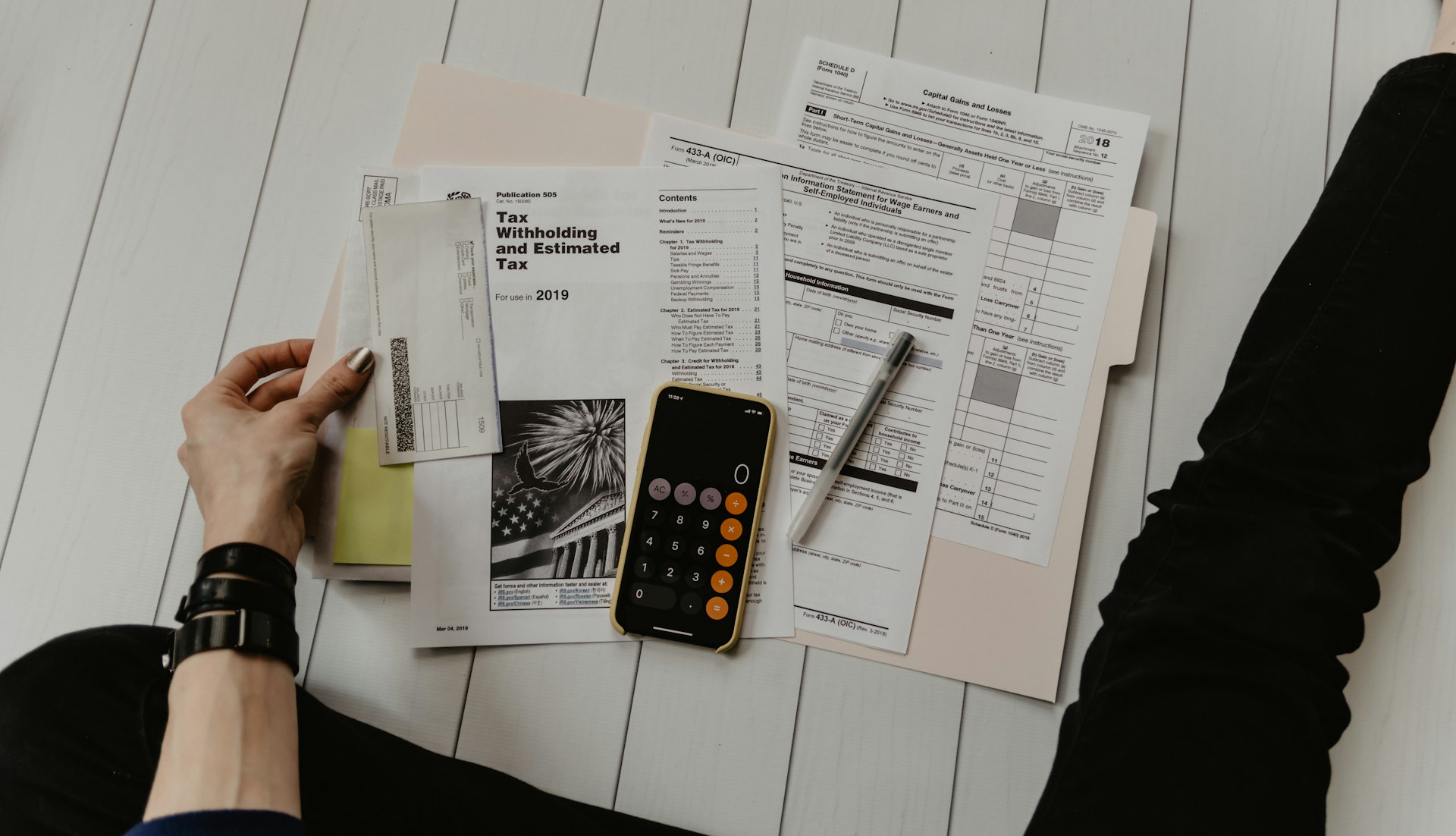

Gather Your Tax Documents

Being organized before you start filing saves time and reduces errors.

Essential Documents to Collect

- Income statements or salary slips

- Bank statements

- Investment or interest income records

- Receipts for deductible expenses

- Previous year’s tax return

Choose the Right Tax Filing Method

There are different ways to file your taxes, and the right choice depends on your situation.

Common Filing Options

- Filing online using tax software

- Filing manually with paper forms

- Hiring a tax professional or accountant

Each option has its benefits depending on the complexity of your finances.

Step-by-Step Tax Filing Process

Step 1: Calculate Your Total Income

Include all income sources such as:

- Salary or wages

- Business or freelance income

- Rental or investment income

Step 2: Claim Eligible Deductions and Credits

Reduce your taxable income by claiming all deductions and credits you qualify for.

- Work-related expenses

- Education costs

- Medical expenses

- Charitable contributions

Step 3: Review Your Tax Return Carefully

Before submitting, double-check all details.

- Verify personal information

- Confirm income and deduction amounts

- Review calculations for accuracy

Step 4: Submit Your Tax Return

File your return through your chosen method and keep a copy for your records.

- Save confirmation receipts

- Note important reference numbers

Common Tax Filing Mistakes to Avoid

Avoiding mistakes can save you from penalties and unnecessary stress.

Frequent Errors Include

- Missing income sources

- Incorrect personal details

- Forgetting to claim deductions

- Filing after the deadline

Tips for a Smooth Tax Filing Experience

- Start early to avoid last-minute pressure

- Keep digital copies of all documents

- Use reliable tax tools or professional help

- Stay informed about tax law changes

After Filing: What Happens Next?

Once your return is filed:

- You may receive a refund if you overpaid taxes

- You may need to pay any remaining tax due

- Tax authorities may contact you for clarification

Keeping records ensures you’re prepared for any follow-up.

Final Thoughts

Filing your taxes doesn’t have to be overwhelming. With proper preparation, organized records, and a step-by-step approach, you can file accurately and efficiently.

Whether you’re an individual taxpayer or a business owner, understanding the tax filing process empowers you to meet your obligations while maximizing your financial outcomes.

Leave a Reply

Your email address will not be published. Required fields are marked *

Subscribe to Our Newsletter

Stay Updated on Tax Insights: Receive regular updates on tax rules, OBBBA developments, planning opportunities, and key filing deadlines.